Everything You’d Expect From Your Accountant

Here’s to small business owners.

We know you’ve got a business to run, clients to attract, customers to keep happy, bills to manage, invoices to chase, employees to motivate, and a million other tasks on the go. Yep, we totally get it. After all, we’re running our own small business, doing the same thing as you every single day.

But we also know that it’s hard to find a good accountant. The small ones are stuck in the dark ages, messing with paper receipts and confusing everyone with balance sheet jargon. And even if you can get the attention of the big firms, their fee quotes will make you wish you forgot your wallet at home.

That’s why we created Numble, an accounting firm dedicated to small businesses.

Small Business Accounting and Tax Services

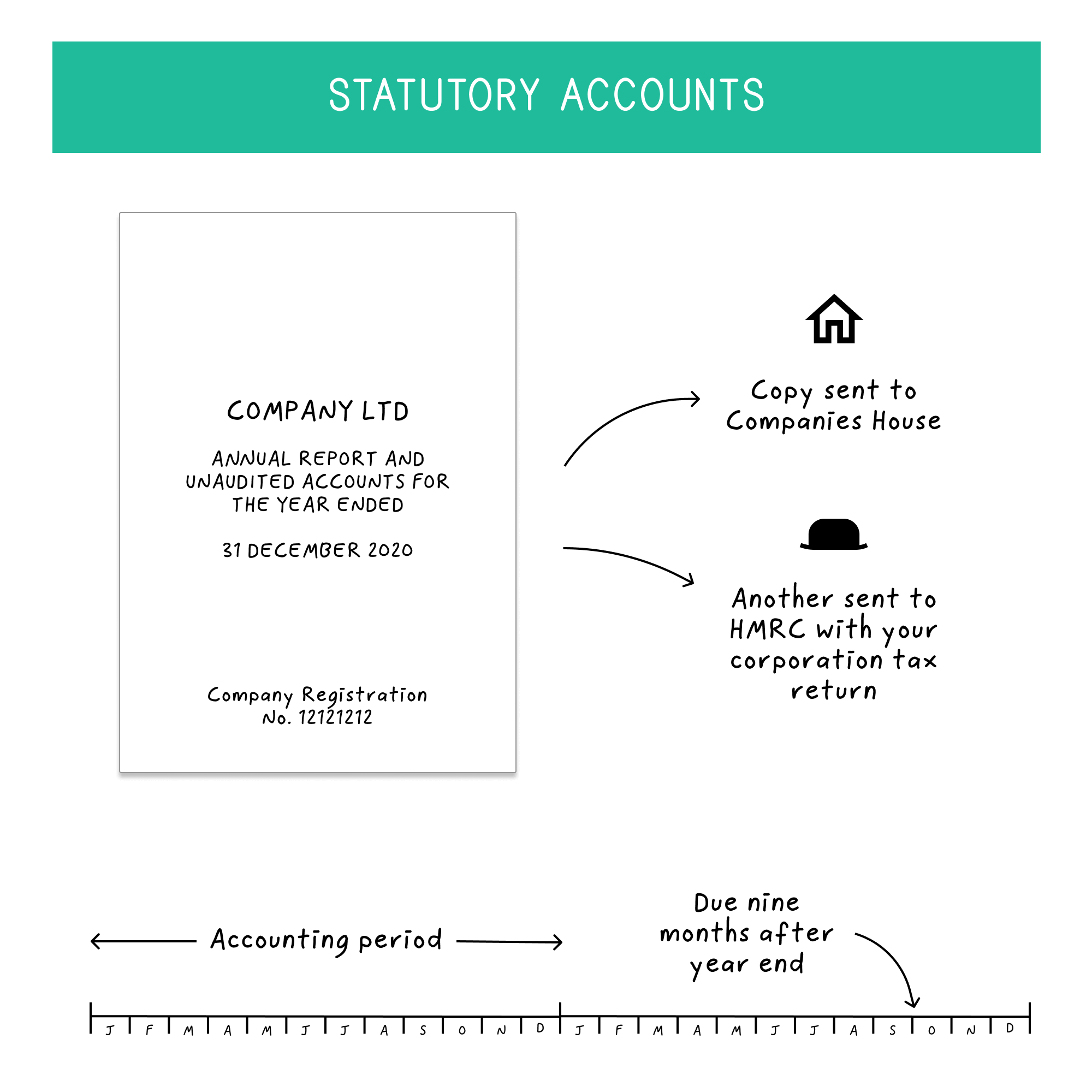

Statutory Accounts

Your statutory accounts detail two things – your profits for the year and your financial position at the end of it. It’s a high-level overview of your business’ financial performance. You typically file the accounts at HMRC and Companies House annually although there are exceptions. The filing deadline is nine months after the end of your accounting period, and many companies use the full nine months before submitting them (and some even longer).

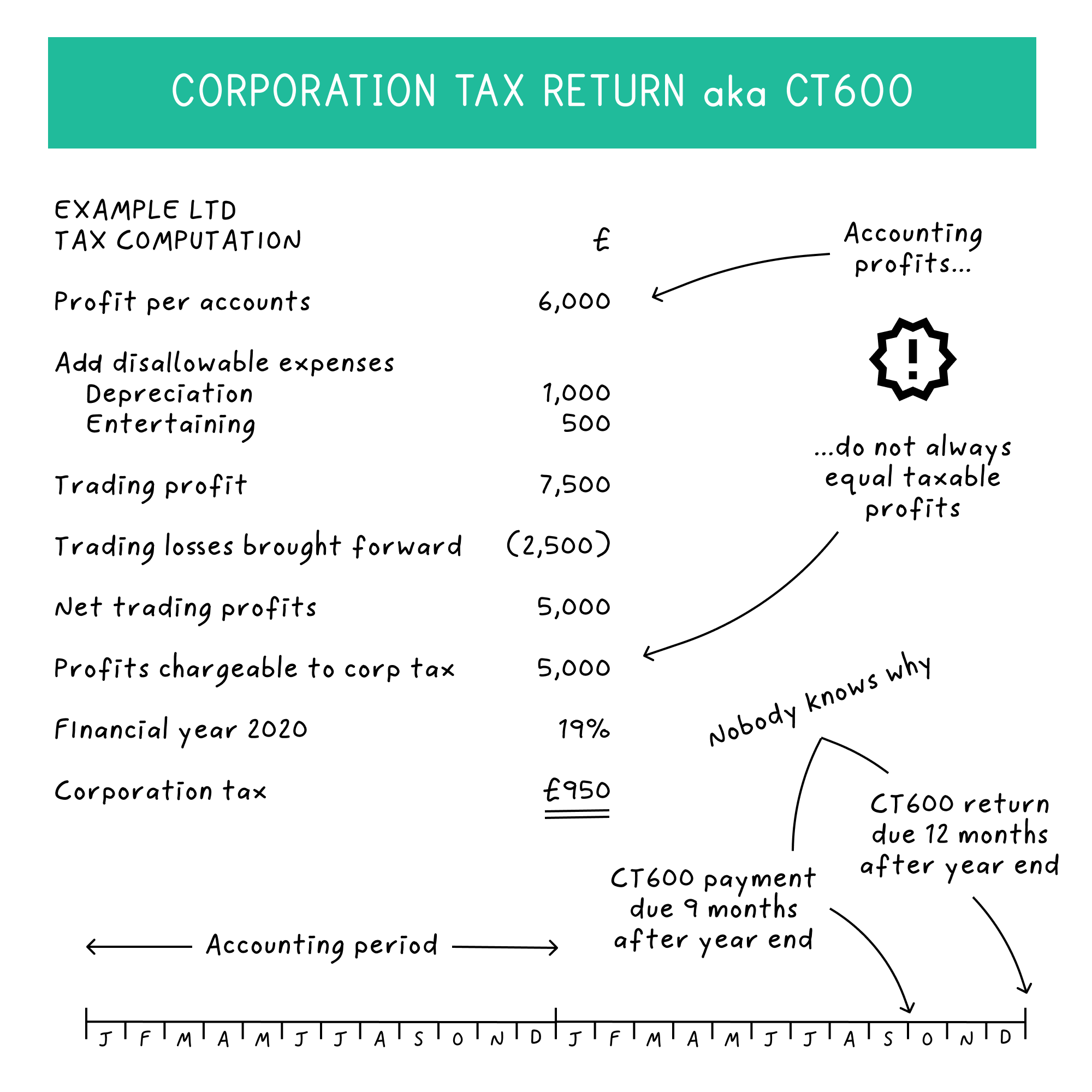

Corporation Tax Returns

Corporation tax is payable each year as a proportion of your trading profits. These profits tend to differ from your accounting profits because accounting standards differ from tax standards. This may sound a little odd but there are good reasons for it. The corporation tax return, or CT600, is usually due three months after your statutory accounts. The tax computations need to be completed before filing the final accounts, and most companies file them together.

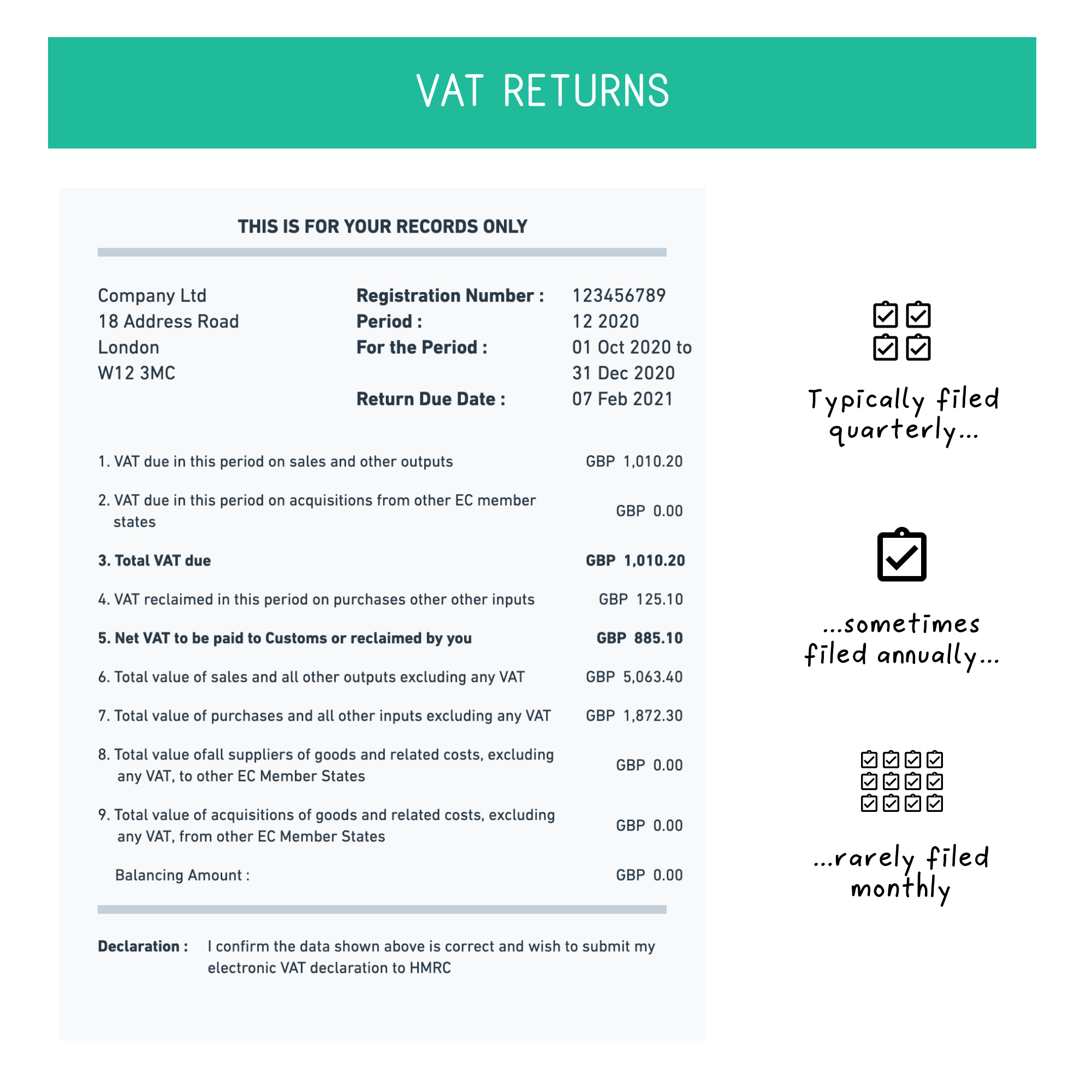

VAT Returns

VAT is a consumption tax, not a business tax. Small businesses that are not registered for VAT act just like individuals, paying VAT on what they consume. But larger companies – that are VAT registered – can reclaim VAT that they have paid while repaying to HMRC any VAT that they have collected.

They do this through VAT returns – usually quarterly – though it is sometimes possible to file monthly or annually. You are given one month and seven days to submit each VAT return, and – once again – companies tend to use up as much of the time limit as possible. (But not our clients!)

PAYE, Payroll and Automatic Enrolment

Long before you hire your first employee you’ll usually register as an employer so you can place yourself and other founders of your business on the payroll. You’ll be able to take advantage of tax and national insurance personal allowances, as well as national insurance tax breaks that are available to small businesses. But payroll comes with lots of deadlines – and automatic penalties for missing them.

Pensions are probably the least exciting thing about running a business, but nearly all companies must now provide a pension for their employees. We’ll guide you all the way.

Self-Assessment Tax Returns

We prepare personal tax returns for our business clients. It’s common for an owner’s personal taxes to be inherently linked with their company’s business taxes. How you pay yourself – in the form of salary, bonuses, dividends and perks – should be carefully considered to minimise your tax burden.

Accounting, Tax and Business Advice

Naturally, we provide all the advice you’d expect from your accountant. But we try to go that little bit further than most. We like to get to know our clients and help to grow their businesses.

Get an instant online quote

We keep things simple with monthly plan fees, no minimum term, and unlimited tax advice.

Get in touch

Based in London, we work with small businesses in the UK. Ask us anything.